when are property taxes due in illinois 2019

REAL ESTATE TAX DUE DATES. Welcome to Ogle County IL.

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Taxes for residential real estate are due for the first time on June 4 2019.

. Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Property Tax Mchenry Pin On Finance. 2019 payable 2020 tax bills are being mailed May 1. Taxpayers can pay their taxes in two installments.

Contact your county treasurer for payment due dates. Contact a County Board Member. Tax Year 2020 First Installment Due Date.

Learn about County Financials. Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due. The delayed property tax payment enables property owners an additional two 2 months to pay their taxes that were originally due on August 3.

For now the September 1 deadline for the second installment of property taxes will remain unchanged. Property tax bills mailed. Illinois has one of the highest average property tax rates in the.

Once you locate your tax bill a pay tax online link will be available. The Illinois Department of Revenue does not administer property tax. If you are a taxpayer and would like more information or forms please contact your local county officials.

In most counties property taxes are paid in two installments usually June 1 and September 1. The property tax due dates are May 15 for the first and October 15 for the second instalment. Mobile Home Due Date.

Conducts annual sale of delinquent real estate taxes. Winnebago County collects on average 239 of a propertys assessed fair market value as property tax. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

State statute allows a. Frederick School News Great Lakes Naval Base Lake County Color Guard. Once you view the website you will be able to search by parcel number owner name and address.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax. Kendall-Grundy Community Action 1802 N Division St Suite 602. Tax Year 2021 First Installment Due Date.

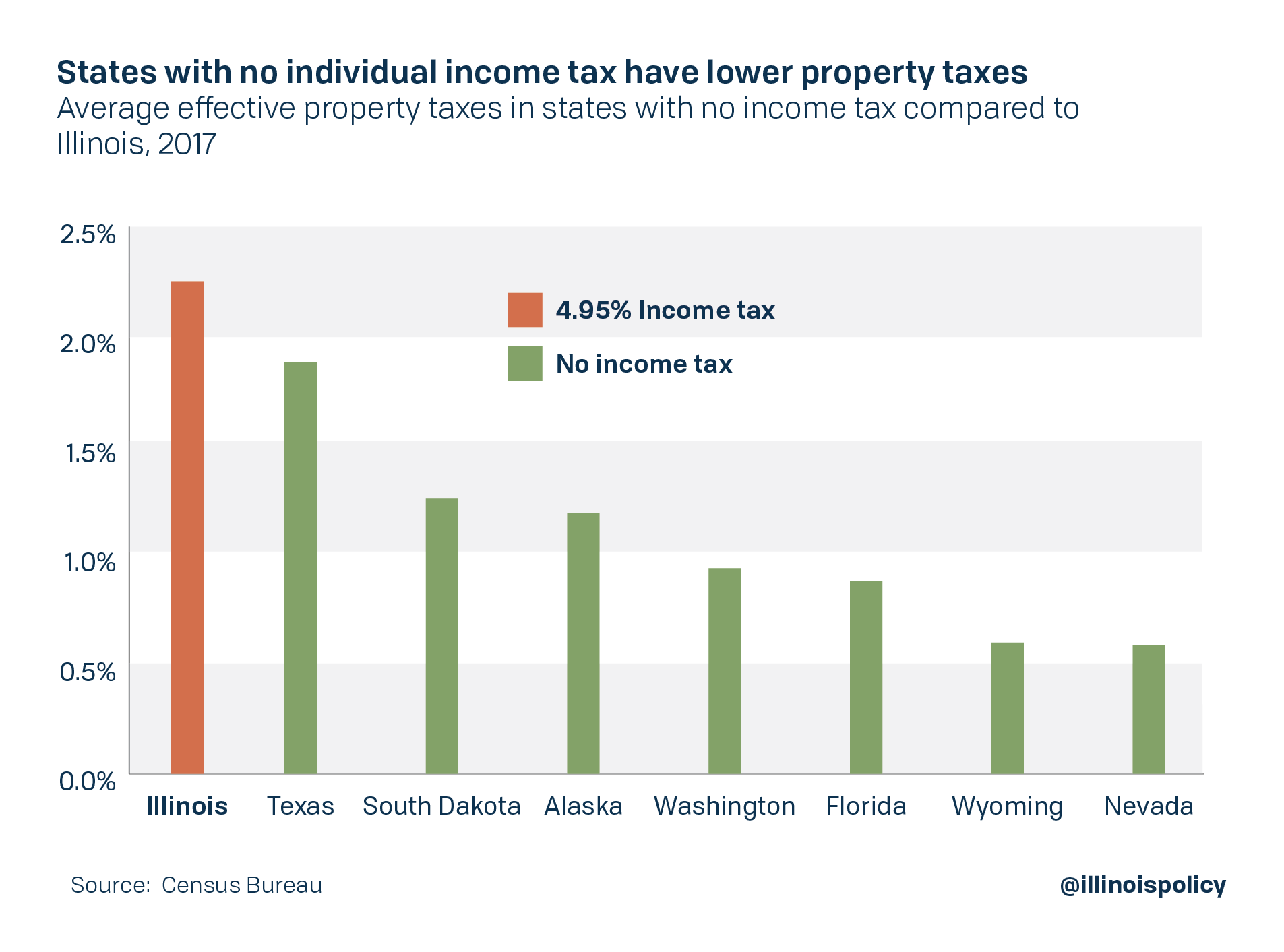

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Monday February 14 through Tuesday March 2 2022 2019 Annual Sale. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes.

15 penalty interest added per State Statute. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Logan County Department of Public Health.

There are several convenient ways to pay your real estate property taxes. 2021 TAX YEAR TO BE COLLECTED IN 2022. The date may vary between counties.

Paula Miller County Treasurer 101 North Fourth Street Suite 202 Effingham IL 62401 Phone. Tuesday March 1 2022. Welcome to Ogle County IL.

Election Night Results Contact Calendar Agendas Minutes Maps Employment. The last day to pay the Tax Year 2019 Second Installment before late-payment interest charges was Thursday October 1 2020. Information related to COVID-19 affecting Logan County IL.

Billing and Collection of nearly 66 million real estate taxes. Tax amount varies by county. Lee County does take credit card paymente-check.

Pay Property Tax Online Illinois Property Tax Appeal Board PTAB Common Questions. The first installment due June 1 will be accepted without late penalty interest payments if paid on or before July 1. General Information and Resources - Find information.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Animal Control 310 E Dupont Rd. Physical Address 18 N County Street Waukegan IL 60085.

When does County Board Meet. Property Tax Second Installment Due Date. If you think you have been exposed to COVID19 and develop a fever and symptoms such as cough or difficulty breathing call your healthcare provider for medical advice.

2021 Real Estate Tax Bills. 111 E Illinois Ave. Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021 Tax Sales 2022 Scavenger Sale.

45 penalty interest added per State Statute. It is managed by the local governments including cities counties and taxing districts. Last day to submit changes for ACH withdrawals for the 1st installment.

Commission 1320 Union Street Morris IL 60450. 3 penalty interest added per State Statute. Tax Year 2020 Second Installment Due Date.

Any property owner may pay their second installment of the 2019 property tax by October 1 without any penalties or late fees. State law requires a 15 percent interest fee per month on late payments. Important Tax Due Dates.

Property Tax First Installment Due Date. 173 of home value. How to Pay Your Tax Bill.

It is too early to determine the due dates for the 2021 real estate tax bills payable in 2022 but hopefully sometime in October and November will be the due dates. In person weekdays from 830 AM 430 PM at the Will County. 1st installment due date.

Morris IL 60450. For most taxpayers winter taxes are due February 14 while the deadline for summer taxes is September 14. Mail payments to Will County Collector PO Box 5000 Joliet IL 60434-5000.

Administration Office 1320 Union St. The second installment is due September 1. The due date for Tax Year 2019 Second Installment was Monday August 3 2020.

When are property taxes due in illinois 2019 Friday June 17 2022 Edit. January 20 2020 - Dr. To pay taxes online please visit the Lee County Property Tax Inquiry website to access your tax bill.

At one of many bank and credit union branches across Will County. Friday October 1 2021. When are property taxes due in illinois 2019 Sunday February 27 2022 Edit It is managed by the local governments including cities counties and taxing districts.

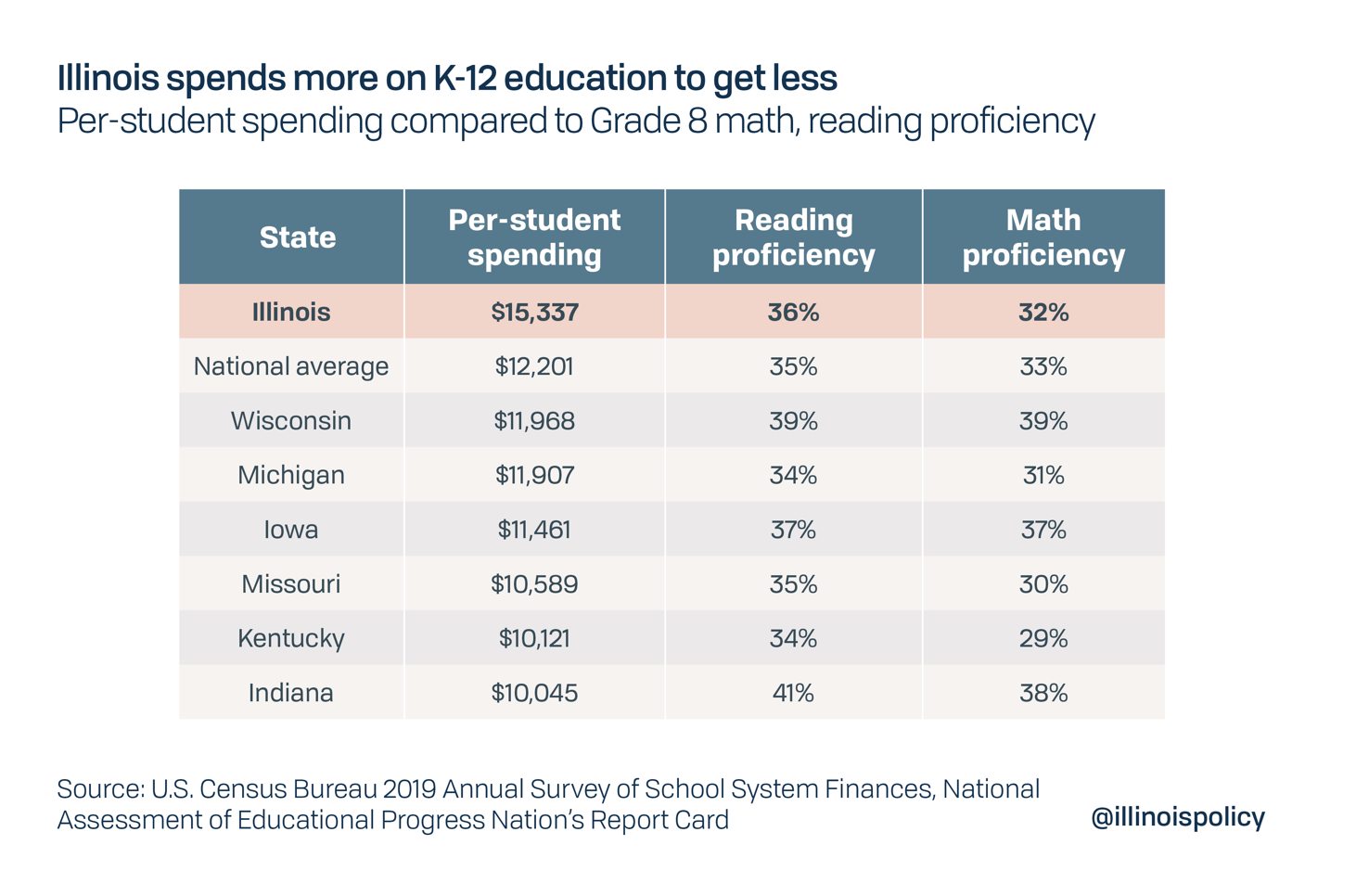

Bureaucrats Over Classrooms Illinois Wastes Millions Of Education Dollars On Unnecessary Layers Of Administration Illinois Policy

State Corporate Income Tax Rates And Brackets Tax Foundation

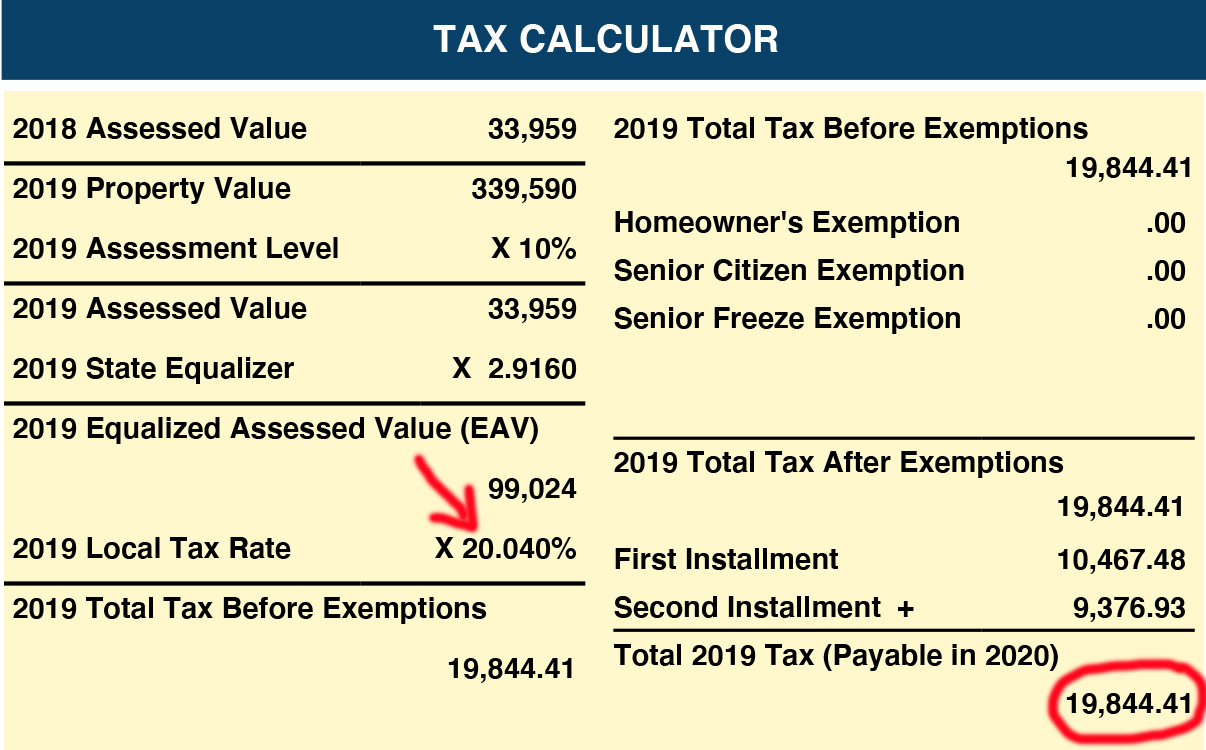

The Cook County Property Tax System Cook County Assessor S Office

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

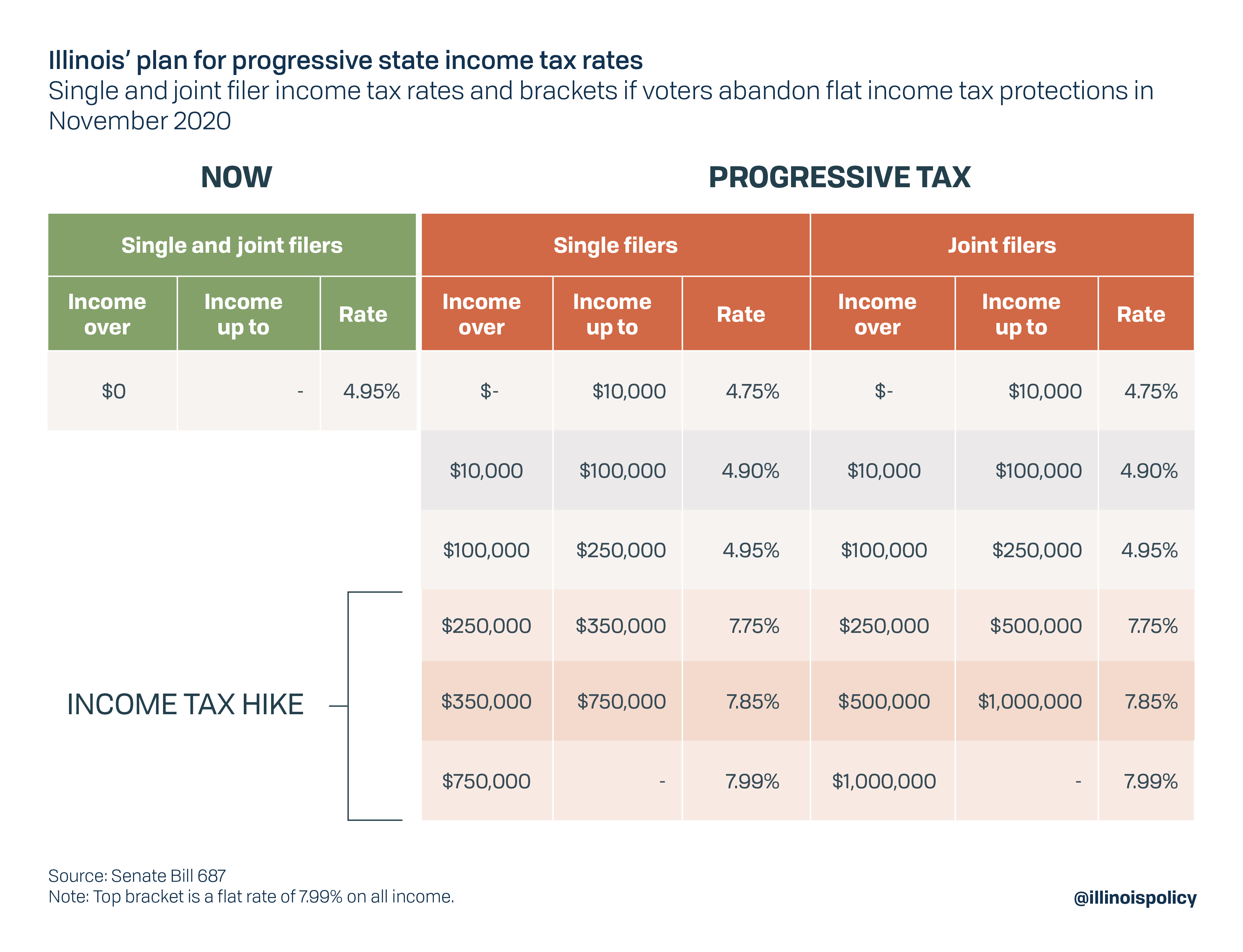

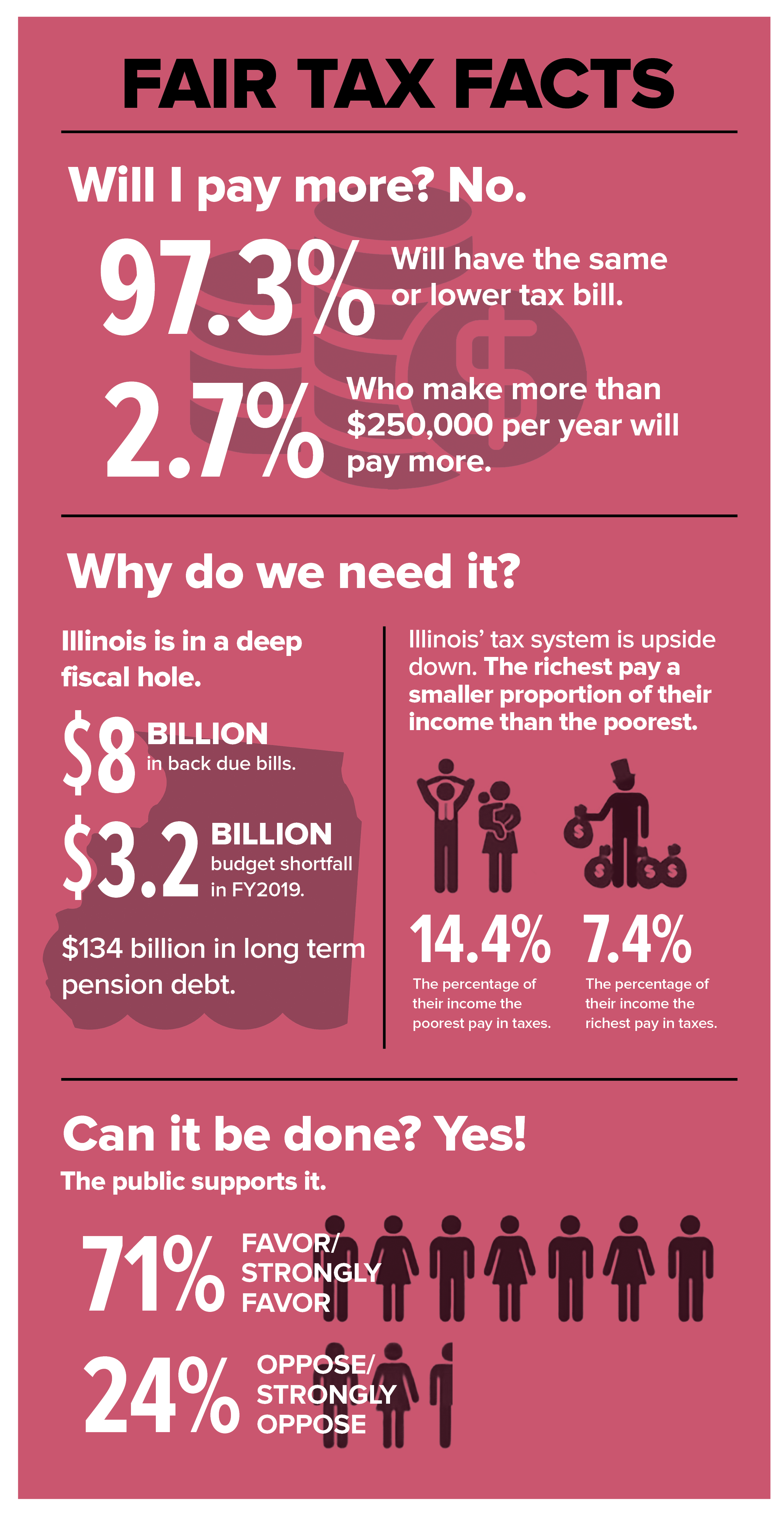

Progressive Income Tax Study Guide

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

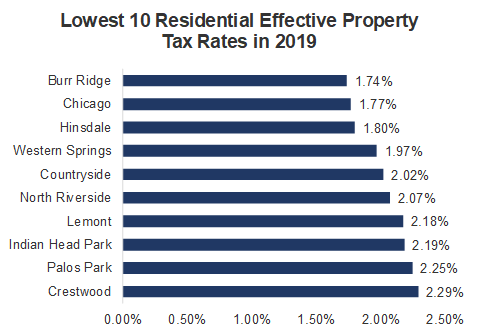

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running

Tax Information Village Of River Forest

Bureaucrats Over Classrooms Illinois Wastes Millions Of Education Dollars On Unnecessary Layers Of Administration Illinois Policy

These Are The Best And Worst States For Taxes In 2019

Expected 7 5 Billion In Federal Aid Won T Fix Illinois Budget Crisis Without Structural Reforms

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

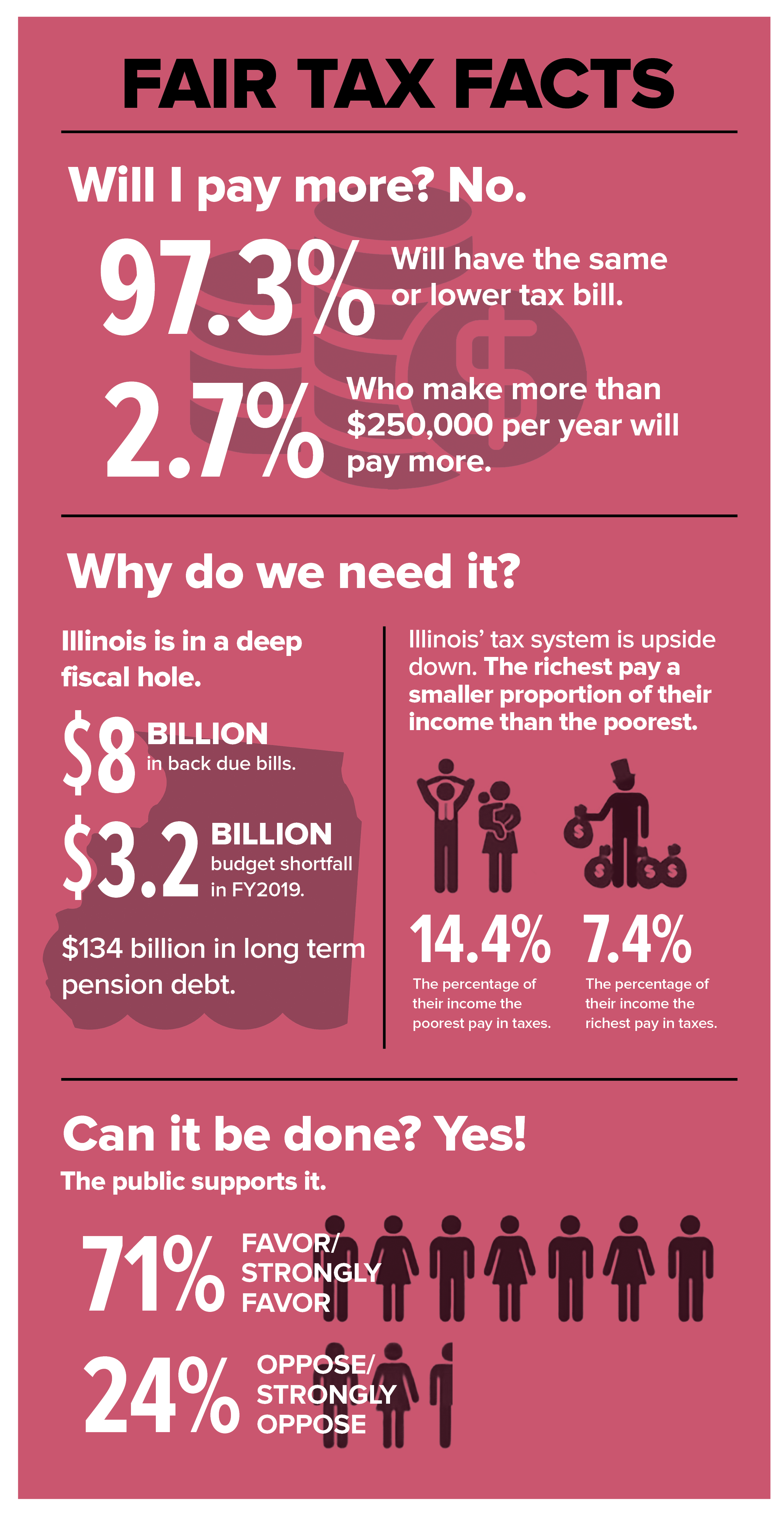

Illinois Needs Fair Tax Reform Afscme Council 31

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation